NBA: Cavaliers take hefty tax hit – reports

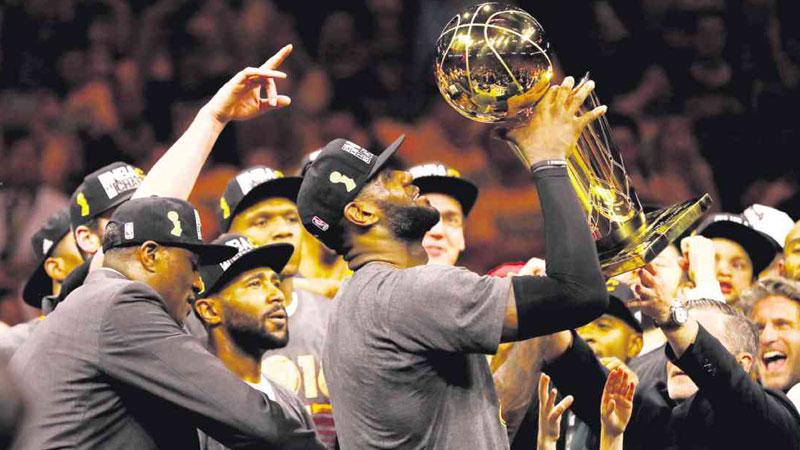

EPIC WIN LeBron James raises the Larry O’Brien Championship Trophy after the Cleveland Cavaliers defeated the Golden State Warriors 93-89 in Game 7 to win the 2016 NBA Finals at Oracle Arena on Sunday in Oakland, California. AFP

The champion Cleveland Cavaliers will pay a league-high $54 million luxury tax for last season for going over salary cap limits on their title-team payroll, ESPN said Sunday.

Owner Dan Gilbert will have to send the league a check for salary overruns in the championship season that brought Cleveland its first sports champion since 1964.

Seven teams in all exceeded the $84.7 million tax threshold for last season, the Cavaliers most of all, with a whopping $160 million payroll, Cleveland.com reported.

The Clippers owe $19.9 million in luxury tax, followed by Golden State at $14.8 million, Oklahoma City Thunder at $14.5 million, San Antonio and Houston at $4.9 million and Chicago at $4.2 million.

LeBron James, who rejected a $24 million deal to become a free agent, says he plans to re-sign with the Cavs and likely will be paid $27.5 million for next season by Cleveland because of a higher salary cap.

The NBA Finals MVP averaged 29.7 points, 11.3 rebounds and 8.9 assists in leading the Cavaliers over Golden State in seven games in last month’s finals