Unreasonable.

No amount of support from his peers in Congress would convince Malacañang to spare the boxing hero-turned-legislator from ever paying taxes.

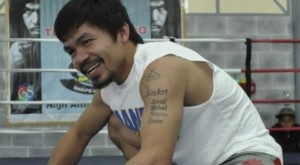

Communications Secretary Herminio Coloma told reporters at a briefing that granting world boxing champion and Sarangani Rep. Manny Pacquiao a lifetime tax exemption would be “unreasonable” since “paying taxes is one of the basic obligations of every Filipino citizen.”

Tax exemptions are based on one’s capacity to pay, he said.

In a separate interview, Coloma said he found it incredulous for the government to extend such privilege to Pacquiao despite his great achievements in boxing.

The secretary said it would be difficult to justify the enactment of such a bill even if a group of athletes were to be covered by the tax exemption because of the equal protection clause of the Constitution.

Citizen’s duty

“I maintain that it is the basic duty of every citizen to pay taxes. Taxes are the lifeblood of government. Thus, it is the right of every citizen to be represented in government decision-making (process),” Coloma told the Inquirer.

Valenzuela Rep. Magtanggol Gunigundo has filed a bill that would give Pacquiao the lifetime tax exemption as a fitting expression of the nation’s gratitude to the “People’s Champ” for his achievements in the boxing world.

Gunigundo described Pacquiao as a “superhuman defined by a multitude of passions” and an “exemplar of humility.”

Independent lawmakers led by Buhay party-list Rep. Lito Atienza have also filed a separate bill that would stop the government from requiring the boxing superstar and other national athletes who win prizes and awards in international competitions to shell out almost a third of their hard-earned winnings in taxes.

Atienza’s bill provides tax exemptions for prizes of both amateur and professional Filipino athletes in sports competitions sanctioned by international groups or certified by the Philippine Sports Commission.

Retroactive

The exemption, if enacted, would be retroactive as it would apply to prizes and awards in all competitions earned 10 years prior to the effectivity of the proposed law.

As a consequence of the exemption, those who had paid taxes for the prizes or awards they had received in internationally recognized competitions within the last 10 years of this act would be entitled to tax credits, the bill proposes.

At a briefing in the Palace, Coloma reminded lawmakers that paying taxes was not an “obligation” that a citizen could just do away with.

“So our view is that this proposed (bill) is not reasonable,” said Coloma.

Capacity to pay

Asked if certain citizens would be entitled to this privilege under certain circumstances, he said:

“To my knowledge, the exemptions are based on the capacity to pay. So the usual exemption is [computed based on] the number of members of the family of the taxpayer, [or the taxpayer’s] dependents; the minimum wage earners; [and] those earning fixed income whose withholding tax has been withheld [by their employers],” he said.

The minimum wage earners and fixed-income earners are no longer required to file their income tax returns, he said.

Coloma said these were the type of exemptions that current laws contemplate.

“What is being proposed refer to exempting all athletes, and since Congressman Pacquiao is an athlete, they are using that general frame,” Coloma noted.

Coloma, however, said the government held the view that “supporting their government by paying correct taxes on time is an important duty of the people.”

“So if this is our basis (for tax exemption), in our view, that is not justifiable,” he said.

RELATED STORIES:

Bill seeks lifetime tax exemption for Pacquiao for ‘making Filipinos proud’

Allies seek tax exemption law for Pacquiao