NBA: Cavaliers take hefty tax hit – reports

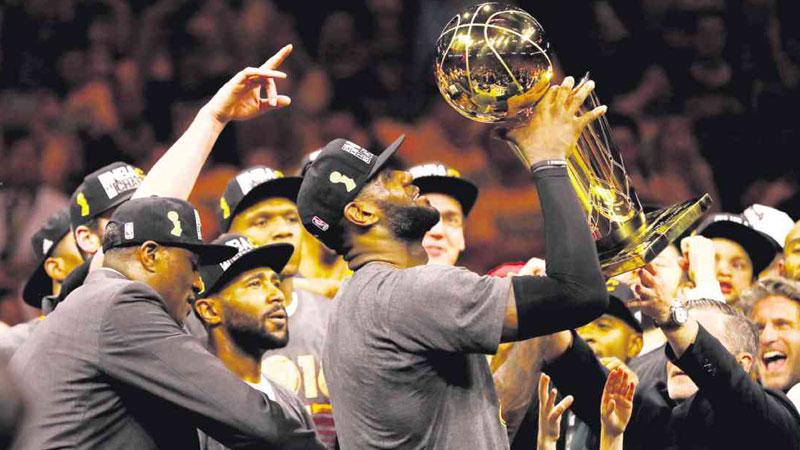

EPIC WIN LeBron James raises the Larry O’Brien Championship Trophy after the Cleveland Cavaliers defeated the Golden State Warriors 93-89 in Game 7 to win the 2016 NBA Finals at Oracle Arena on Sunday in Oakland, California. AFP

The champion Cleveland Cavaliers will pay a league-high $54 million luxury tax for last season for going over salary cap limits on their title-team payroll, ESPN said Sunday.

Owner Dan Gilbert will have to send the league a check for salary overruns in the championship season that brought Cleveland its first sports champion since 1964.

Article continues after this advertisementSeven teams in all exceeded the $84.7 million tax threshold for last season, the Cavaliers most of all, with a whopping $160 million payroll, Cleveland.com reported.

The Clippers owe $19.9 million in luxury tax, followed by Golden State at $14.8 million, Oklahoma City Thunder at $14.5 million, San Antonio and Houston at $4.9 million and Chicago at $4.2 million.

LeBron James, who rejected a $24 million deal to become a free agent, says he plans to re-sign with the Cavs and likely will be paid $27.5 million for next season by Cleveland because of a higher salary cap.

Article continues after this advertisementThe NBA Finals MVP averaged 29.7 points, 11.3 rebounds and 8.9 assists in leading the Cavaliers over Golden State in seven games in last month’s finals